Public policy is often awash in jargon and acronyms. It can be challenging for the average citizen to discern the purpose of a speech or a bill. Environmental, social, and corporate governance factors (ESG) and artificial intelligence (AI) are two recent examples of terminology that has dominated conversations in the media and in state houses. ESG and AI are both wide-ranging, quickly developing fields. As such, lawmakers and the public are seeking to better understand and regulate both. ESG and AI are also central to our current political discourse, due to their impacts across various issue areas. Any development within either field has downstream implications for labor, the environment, finance, government, and more.

In this article, we examine ESG and AI in more detail, including their impacts on each other, potential risks, and best practices.

What is ESG?

ESG is generally applied in two slightly different contexts. First, ESG investing involves investors distributing their capital based on the impact of the firm they are investing in. This a market-driven approach to corporate responsibility. It’s been around for decades, but was popularized during the 2000s due to consumer demand.

The second context in which ESG comes up is with government-mandated benchmarks or reporting. Regulatory bodies often require corporations to meet reporting standards regarding their impact. More rarely, corporations may be required to meet certain thresholds. Within either context, the “impact” measured by ESG criteria may include:

- Greenhouse gas emissions

- Supply-chain standards

- Management of compliance risks

ESG Around the World

Europe has been a leader in regulating ESG. The European Union (EU) recently enacted the Corporate Sustainability Reporting Directive (CSRD) as its new mandatory sustainability reporting requirements for certain companies. The CSRD requires more detailed reporting and applies to more companies than the EU’s previous framework. Elsewhere, the United States is the center of a growing backlash against ESG regulations. Anti-ESG legislation was introduced in 37 states in 2023. Barring federal action, U.S. ESG law will likely become a confusing landscape for companies to navigate.

What is Artificial Intelligence?

Artificial intelligence (AI) refers to machines’ programmed ability to “think,” or operate in a way that resembles human cognition. There are many distinct AI technologies, and countless applications. Generally, the goal of AI technology is to empower computers to complete tasks that typically require or even exceed human intelligence.

In 2023, the AI field saw significant progression. The most visible AI-powered projects were the subject of much attention and scrutiny from the public, media, and lawmakers. AI is rapidly advancing and has the potential to continue to develop quickly. As such, many are grappling with how to understand, use, and regulate AI.

AI’s Benefits for ESG

ESG reporting requires companies to gather and report data on a number of factors. This can be an overwhelming and arduous process, especially for those with the largest impacts. One area in which AI has shown its utility is in processing and summarizing large data sets. It’s easy to imagine how corporate disclosures could be made more efficiently and accurately with the help of AI.

Once reporting is complete, AI’s use cases continue. AI can potentially make this information easier to navigate for a citizen, investor, or customer. Much of the motivation behind requiring ESG transparency is an assumption that customers will use this information to inform where they spend their money. This leads to a feedback loop that encourages corporate responsibility. But this system only works if that information is accessible and digestible by the public. It isn’t yet clear that ESG reporting has led to a significant change in consumer attitudes so far. Generative AI, like the technology behind ChatGPT, might simplify access to this information, increasing the impact of ESG transparency on public behavior.

AI also has a role to play in the ongoing debate about the efficacy of ESG regulations. In the United States, much of the debate around ESG regulations has ventured into culture-war territory. However, there is still debate whether ESG investing, reporting, and mandates are effective in improving corporate responsibility. For example, some climate activists have begun to push back on the prevalence of “greenwashing” spurred by growing ESG requirements. Assessing the long-term impact of ESG regulations is a big data task, one that AI will be helpful in accomplishing.

What are the ESG risks of AI?

Like any developing technology, AI comes with risks. What feels unique about AI, however, is the mystery surrounding what those risks might be. In this case, it can be helpful to isolate the risks of certain types of AI applications when assessing the impact of AI on a given field.

Human Bias

A primary risk of AI technology when applied to ESG is the automation of human biases in the workplace. AI technologies are heavily reliant on the data that goes into their training. It is a fact that existing human biases can impact that training data. AI-driven hiring decisions, for example, could be based on historical data that includes racial or gender biases. As more and more companies empower their processes with AI, it will be important to account for potential biases.

Inaccurate Information

AI may ease the process of ESG reporting for companies. However, there are risks in trusting AI-powered tools to complete these tasks with the necessary accuracy. AI models’ “hallucination” of inaccurate information has already given governments and corporations pause. Given the rapid development of ESG policy, there is risk that automating too much ESG reporting could open a company to compliance risks.

Environmental Concerns

Use of AI also has the potential to reverse the progress that ESG principles aim to protect. AI-powered tools require significant energy, which in turn has a negative environmental impact. A recent Scientific American article noted that the 1.5 million server units that NVIDIA will deploy each year will consume more energy than some small countries. As we transition our electric grid away from fossil fuels and towards renewable energy, this impact will diminish — but that transition is far away.

AI-driven advances in technology also benefit the processes that have led to our current environmental situation. Applications of AI in the mining industry as well as in other industries that harm the environment could worsen their climate impact. At the same time, many hope that AI will unlock technological breakthroughs that help mitigate emissions and climate change.

Job Displacement

Automating human cognition also invites potential for job displacement. Measuring the social impact of AI must include an assessment of any job or income losses tied to its advancement. Innovative technologies have long been blamed for job losses, especially in the short-term. This blame is not always misplaced. England’s Luddites of the early 19th century have historically been dismissed for raising alarm about the impact of automation in the manufacturing space on laborers. But arguments justifying their opposition and questioning the inequities in technology progress have gained steam recently, including in Gavin Mueller’s recent book, “Breaking Things at Work.” Whether AI will expand or minimize inequities remains to be seen, but those implementing ESG regulations should account for any short-term impact to laborers.

Best Practices for Balancing AI’s Risk and Benefits for ESG

It would be impossible to comprehensively list AI’s risks and benefits for ESG. Due to the rapidly advancing nature of each field, some benefits and risks may not even be on the radar yet. Regardless, there are lessons to be learned and best practices to be implemented when it comes to the intersection of AI and ESG.

First, companies should be methodical and transparent in their approach to using AI. Transparency and accountability is at the heart of ESG requirements. Companies should keep this in mind when considering AI’s implications for their impact. This approach will mitigate risk and invite feedback while still allowing for AI adoption and its beneficial impacts.

Individuals, whether acting as a citizen, consumer, or investor, should view AI’s applications in ESG as a gateway to accessing more information. Verifying information from automated reporting or generative AI against source data is an important step in validating the model used.

Everyone can benefit from past experiences with new technology. Digital literacy is increasingly important as AI expands its reach. Individuals and companies should always prioritize data security and privacy protection. This need becomes ever more important when accounting for additional uses of AI.

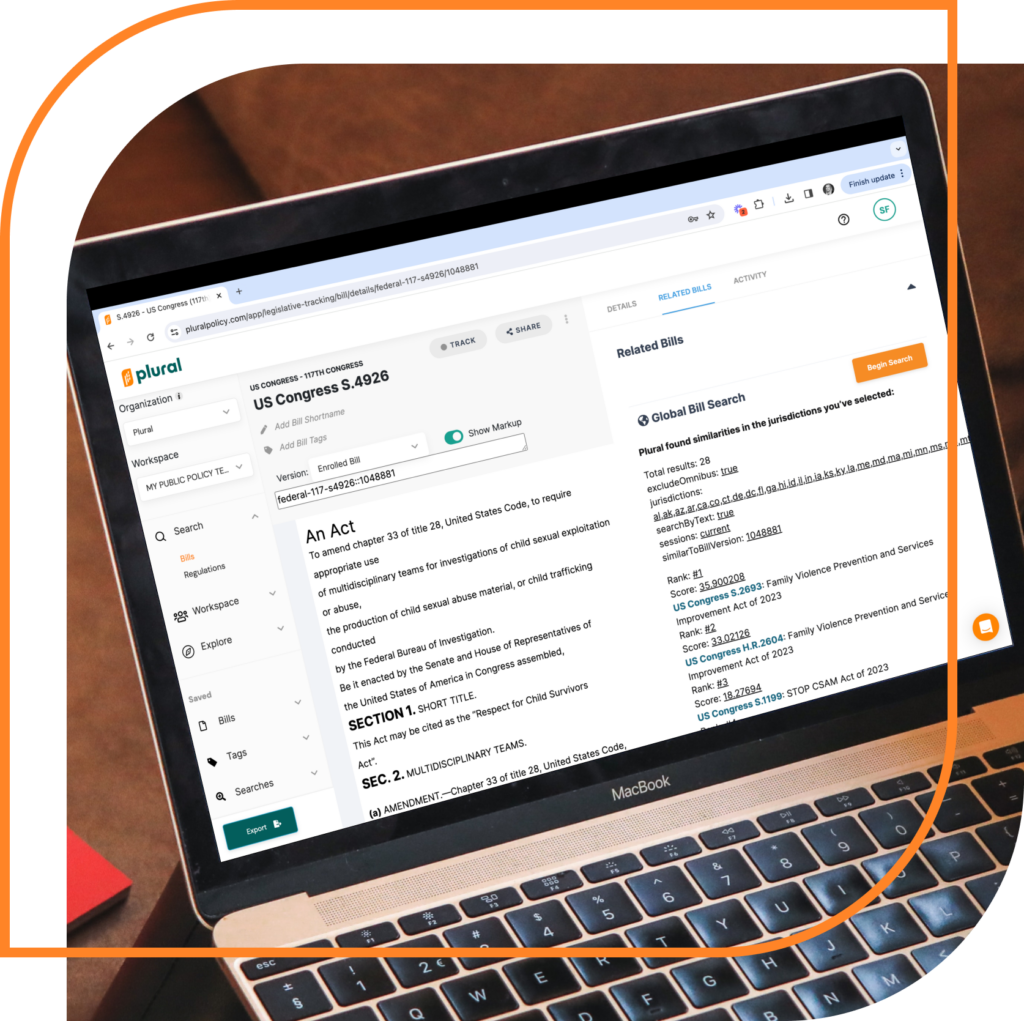

Finally, staying up to date is a great way to see the benefits and risks of AI’s use in ESG in action. 2023 saw plenty of successes and lessons learned in both fields and 2024 will be no different. Staying on top of the issue is challenging, but one avenue for anticipating what is next is to track state and federal policy proposals. Plural’s advanced policy intelligence tools make this easy and accessible, and we do so by responsibly leveraging AI!

More Resources for Public Policy Teams

Plural Asks: Get to Know a Policy Pro, Dr. Vineeta Gupta

In this series, you’ll learn about the career paths of impactful public policy shapers and champions. Dr. Vineeta Gupta, Organizational Growth & Philanthropy Strategist | Systems Change Leader Human rights advocacy is about shifting power, holding systems accountable, and building a society where dignity, equity, and freedom, and justice are ensured irrespective of race, gender, […]

Understanding the Byrd Rule: How Senate Rules Will Change the One Big Beautiful Bill Act

It is safe to say we have entered a new phase of President Trump’s second presidency. The chaotic first four months was largely defined by an unprecedented flurry of executive action, Elon Musk’s efforts to shrink the federal bureaucracy, and rising geopolitical tensions resulting from the administration’s trade policies. The centerpiece of this next phase […]

The AI Advantage: What Forward-Thinking Policy Teams Are Doing Differently

As the volume and velocity of policy change accelerates, government relations (GR), legal, and compliance teams are facing mounting pressure to keep up. Traditional tools and workflows are no longer sufficient. Forward-thinking organizations are turning to artificial intelligence (AI) to build smarter, faster, and more strategic policy functions. AI isn’t just a buzzword in this […]